The Income Tax Department is providing the facility for allotment of Instant PAN (“Permanent Account number”) (on a real-time basis) for resident applicants who are desirous of getting PAN and are in possession of a valid Aadhaar number.

E-Permanent Account Number (“e-PAN”)

PAN is a 10-character alphanumeric code issued by the Income Tax department to identify a tax payer, whether an individual, Hindu undivided family (HUF), a company, firm or an association of persons. The PAN card is issued under the provisions of section 139A of the Income Tax Act, 1961.

Furthermore, e-PAN is a digitally signed PAN card issued in electronic format by the Income-tax department.

Salient points of this facility

- The applicant should have a valid Aadhaar which is not linked to any other PAN.

- The applicant should have his mobile number registered with Aadhaar.

- This is a paper-less process and applicants are not required to submit or upload any documents.

- Facility is for New PAN allotment only, not for earlier issued or amendment in old PAN.

NOTE: Possession of more than one PAN will result in penalty of Rs. 10,000.

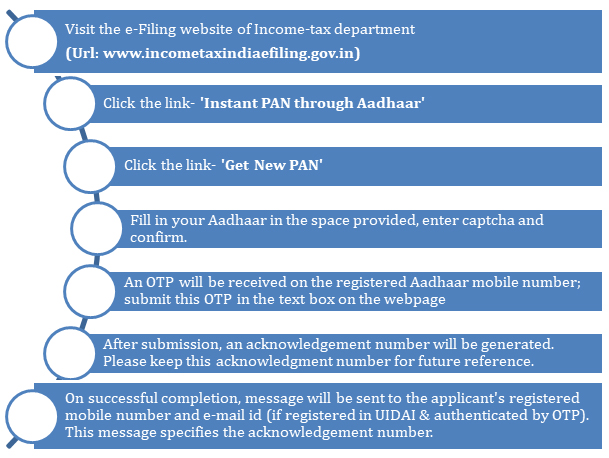

How to apply for instant PAN

How to download PAN

- To download PAN, please go to the e-Filing website of Income-tax department. (Url: www.incometaxindiaefiling.gov.in)

- Click the link- ‘Instant PAN through Aadhaar’.

- Click the link- ‘Check Status of PAN’.

- Submit the Aadhaar number in the space provided, then submit the OTP sent to the Aadhaar registered mobile number.

- Check the status of application- whether PAN is allotted or not.

- If PAN is allotted, click on the download link to get a copy of the e-PAN pdf.

Immediate Impact