LINKING OF PAN WITH AADHAAR

The Central Board of Direct Taxes (“CBDT”) has extended the due date of linking of Permanent Account Number (“PAN”) with Aadhaar from 31st December, 2019 to 31st March, 2020.

This is the third time the due date has been extended. The Supreme Court had in September 2018 declared Aadhaar as constitutionally valid and held that the biometric ID would remain mandatory for the filing of income tax returns and allotment of PAN cards.

As per CBDT, where a person, who has been allotted the Permanent Account Number (“PAN”) as on July 1st, 2017 and is required to intimate his Aadhaar number under sub section (2) of section 139AA, has failed to intimate the same on or before March 31st, 2020, the PAN of such person shall become inoperative immediately after said date for the purpose of furnishing, intimating or quoting under the Act. Furthermore, CBDT via notification amended Income Tax Rules and inserted Rule 114AAA, stipulating the “manner of making permanent account number inoperative”.

MISMATCH IN AADHAR AND PAN

NOTE: Aadhaar number will be linked with PAN if name and date of birth of taxpayer is identical to Aadhaar and PAN.

Earlier, Income-tax Dept. was allowing linking of Aadhaar Number with PAN if there was minor mismatch in the name appearing in PAN compared to the name appearing in Aadhaar Card. Identity of taxpayers were verified by sending One Time Password (OTP) to mobile number registered with UIDAI.

However, with effect from 01-12-2017 UIDAI has discontinued the practice of verifying the user’s identity with OTP. Therefore, Aadhaar number cannot be linked with PAN if there is any mismatch in the name entry in the records of Aadhaar and PAN. Taxpayers are required to rectify either of the documents, PAN or Aadhaar, so as to complete the process of linking these two records.

Thought for Non Resident

Non Residents may not have Aadhar, so to save their PAN to be inoperative following are few solutions available for them:

- Update the Address in PAN database through online filing of application.

- Change of Jurisdiction: Application may be submitted to the jurisdictional Assessing officer.

How to Link Aadhar with PAN?

Aadhaar number can be linked with PAN by any of the two ways:

- Using SMS facility

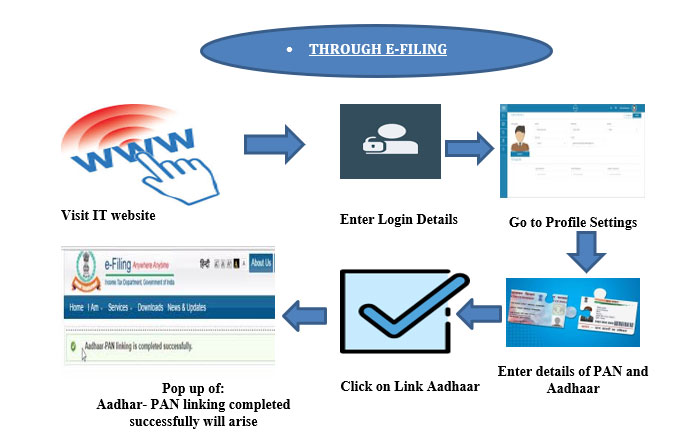

- Using facility on e-filing portal https://incometaxindiaefiling.gov.in

PROCESS OF LINKING AADHAR WITH PAN

Taxpayer is required to send SMS to 567678 or 56161 in the following format:

UIDPAN<space><12 digit Aadhaar number><space><10 digit PAN>

For example: UIDPIN 111122223333 AAAPA9999Q

RISK EXPOSURE

Taxpayers PAN will be treated as invalid if they do not link it with Aadhaar number as the Apex Court has given relief only in those cases where taxpayers did not possess Aadhaar number.

IMPACT ON TAXPAYERS

| POSITIVE IMPACT |

NEGATIVE IMPACT |

|

|

|

|