| Section No.

|

Amendment

|

Impact

|

| Section 96

Annual General Meeting

|

It is proposed that Annual General Meeting (‘AGM’) of unlisted company may be held at anyplace in India if consent is given is writing or by electronic mode by all the members in advance.

|

Now AGM can held in any place in India .

|

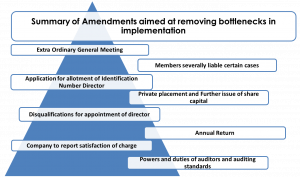

| Section 100(1)

Extra Ordinary General Meeting |

The Board may, whenever it deems fit, call an extraordinary general meeting of the company.

proviso is inserted, namely: Provided that an extraordinary general meeting of the company, other than of the wholly owned subsidiary of a company incorporated outside India, shall be held at a place within India.”

|

The wholly owned subsidiary of a company incorporated outside India is now allowed to hold its extra ordinary general meeting outside India.

Likely to save the time and energy of many companies.

|

| Section 3(A)

Members severally liable certain cases |

New section is inserted regarding liability of members in case number of members is reduced from statutory minimum, i.e. seven in the case of public company or two in case of a private company.

(Provision of old act, 1956)

|

The company carries on business for more than six months while the number of members is so reduced, then every person who is a member of the company during that time, shall be severally liable for the payment of the whole debts of the company contracted during that time, and may be severally sued. |

| Section 153

Application for allotment of DIN *MCA Updates

|

The Central Government to recognize any other identification number to be treated as director identification number.

*The process of allotment of DIN by allotting DIN to individuals only at the time of their appointment as Directors (If they do NOT possess a DIN) in companies |

The Central Government is now empowered to recognize any other universally accepted identification number as an identification document similar to director identification number. It is expected that Central Government will notify Aadhar as DIN.

*MCA is actively considering Aadhaar Integration for availing various MCA21 related services

|

| Section 42 –

Private placement |

Return of allotment (PAS-3) has to be filed within 15 days instead of 30 days.

Money received under the private placement shall not be utilized unless the return of allotment is filed with the ROC. Private Placement offer letter shall not contain any right of renunciation. Company may, at any time, make more than one issue of securities to such class of identified persons as may be prescribed.

|

Time for filing reduced.

There would be ease in the private placement offer related documentation to enable quick access to funds. Earlier it was prohibited Penalty also reduced.

|

| Section 82

Company to report satisfaction of charge

|

Timeline for filing of satisfaction of charge is proposed to be increased to 300 days on payment of additional fee.

|

The provisions of sub-section (1) of section 77 is omitted, now the Registrar may allow such intimation of payment or satisfaction to be made within a period of three hundred days of such payment or satisfaction on payment of such additional fees as may be prescribed.

|

| Section 92

Annual Return

|

It is proposed to omit the requirement of MGT-9 to form part of the Board’s Report. Instead, the copy of annual return shall be uploaded on the website of the company, if any, and its link shall be disclosed in the Board’s report.

It is also proposed to omit the requirement related to disclosing indebtedness and details with respect to name, address, country of incorporation etc.

The Central Government may prescribe abridged form of annual return for One Person Company (‘OPC’), Small Company and such other class or classes of companies as may be prescribed.

|

Likely to save the time and energy of many companies. |

| Section 94

Place of keeping and inspection of registers, returns, etc |

It is proposed to omit the requirement of filing of special resolution in advance with the Registrar of Companies for keeping of the registers and returns at a place other than the registered office of the company.

It is also proposed that certain prescribed particulars in the return, register or index referred to in this section shall not be available for inspection or for taking extracts or copies.

|

Filing of advance copy of proposed special resolution did not serve any purpose, because the special resolution was in any case to be filed as per the requirements of Section 117(3)(a).

|

| Section 140

Removal, Resignation of Auditor and giving of special notice |

It is proposed to reduce the fine in case of failure to file resignation by auditor in Form ADT-3 to fifty thousand rupees or the remuneration of auditor whichever is less

|

Earlier Rs 50,000 which may extend to 5 Lacs

|

| Section 141

Eligibility, Qualification and Disqualifications of Auditors

|

It is proposed that a person who, directly or indirectly, renders any service to the company or its holding company or its subsidiary company will not be eligible for appointment as Auditor.

Currently the restriction is only on the person, whose subsidiary, associate company or any other form of entity is engaged as on the date of appointment in consulting and specialized services as provided in section 144.

|

Directly or indirectly:

accounting and book keeping services; (b) internal audit; (c) design and implementation of any financial information system; (d) actuarial services; (e) investment advisory services; (f) investment banking services; (g) rendering of outsourced financial services; (h) management services; |

| Section 143

Powers and duties of auditors and auditing standards

|

It is proposed to cover associate companies along with subsidiary companies with respect to right of auditors to have access to accounts and records.

The auditor’s report is to include whether internal financial controls with reference to financial statement are in place and not in respect of internal financial control system.

|

The word “Subsidiaries & internal financial control system ” are substituted.

|

| Section164-

Disqualifications for appointment of director

|

When a director is appointed in company which is in default of filing of financial statements or annual return or repayment of deposits or pay interest or redemption of debentures or payment of interest thereon or payment of dividend then such director shall not incur the disqualification for a period of six months from the date of his appointment.

|

Cooling period for newly appointed director is six month.

|